West Baton Rouge Parish 880 N Alexander Avenue Port Allen, LA 70767 Phone: 225-383-4755 Fax: 225-387-0218

Change of Address_1032012 – West Baton Rouge Parish Assessor

The Revenue Division of the City of Baton Rouge Finance Department allows you to file East Baton Rouge sales tax returns via Parish E-File. Sales and Use Tax Due Dates. Find sales and use tax due dates. Sales & Use Tax Guidelines. The City-Parish Finance Director has been designated as the central collector for sales and use tax in East Baton

Source Image: ebrpa.org

Download Image

Try using our Sales Tax Explorer tool. This tool allows you to lookup a location by address or coordinates for an accurate sales/use tax rate and easily calculates your total. Click here for parish and state contact information. Website Support. Phone. (877) 693-4435. Fax. (225) 231-6201.

Source Image: wbrparish.org

Download Image

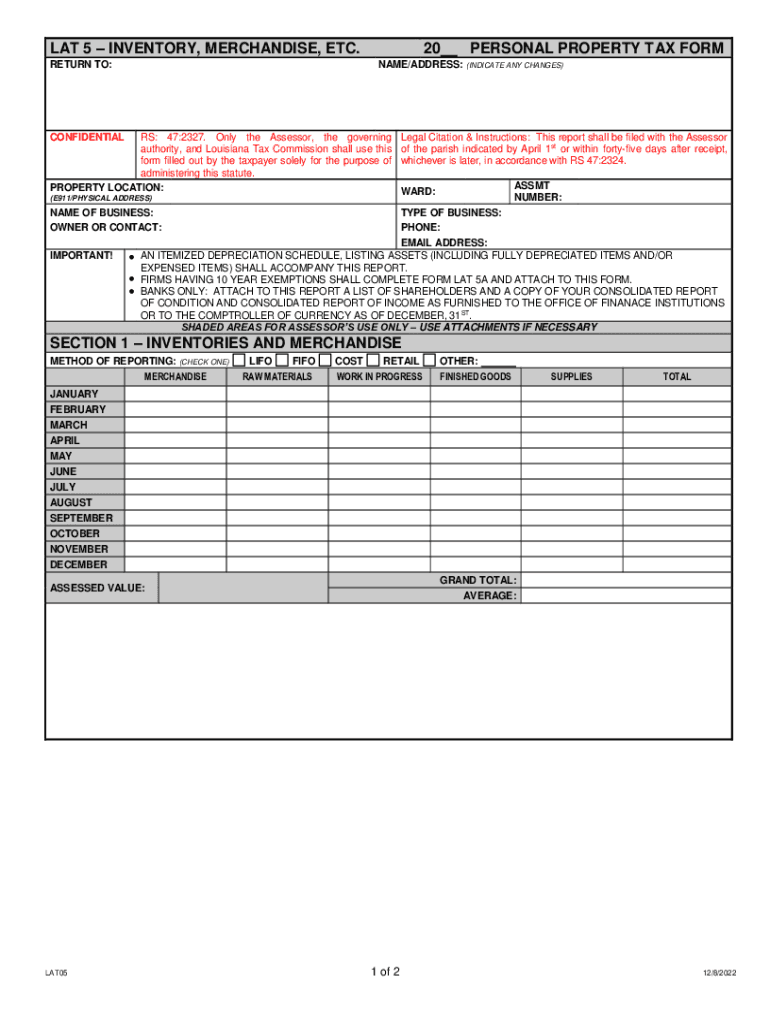

225] Magazine – July 2021 by Baton Rouge Business Report – Issuu Louisiana has a 4.45% sales tax and West Baton Rouge Parish collects an additional 5%, so the minimum sales tax rate in West Baton Rouge Parish is 9.45% (not including any city or special district taxes). This table shows the total sales tax rates for all cities and towns in West Baton Rouge Parish, including all local taxes. City. Sales Tax Rate.

Source Image: dochub.com

Download Image

West Baton Rouge Parish Sales And Use Tax Report

Louisiana has a 4.45% sales tax and West Baton Rouge Parish collects an additional 5%, so the minimum sales tax rate in West Baton Rouge Parish is 9.45% (not including any city or special district taxes). This table shows the total sales tax rates for all cities and towns in West Baton Rouge Parish, including all local taxes. City. Sales Tax Rate. 850 8th Street. PO Box 129. Port Allen, LA 70767. Phone: 225-343-9234. Fax: 225-344-1004. Law Enforcement Resources. Report a Crime. Pay Taxes Online. Pay Tickets Online.

East baton rouge tax assessor property search: Fill out & sign online | DocHub

Welcome to Parish E-File. Parish E-File is an online tool that facilitates secure electronic filing of state and parish/city sales and use tax returns. Taxpayers should be collecting and remitting both state and parish/city taxes on taxable sales. Parish E-File permits the filing of multiple parish/city returns from one centralized site. West Baton Rouge Parish School Board

Source Image: lla.la.gov

Download Image

Keep West Baton Rouge Beautiful Welcome to Parish E-File. Parish E-File is an online tool that facilitates secure electronic filing of state and parish/city sales and use tax returns. Taxpayers should be collecting and remitting both state and parish/city taxes on taxable sales. Parish E-File permits the filing of multiple parish/city returns from one centralized site.

Source Image: facebook.com

Download Image

Change of Address_1032012 – West Baton Rouge Parish Assessor West Baton Rouge Parish 880 N Alexander Avenue Port Allen, LA 70767 Phone: 225-383-4755 Fax: 225-387-0218

Source Image: wbrassessor.org

Download Image

225] Magazine – July 2021 by Baton Rouge Business Report – Issuu Try using our Sales Tax Explorer tool. This tool allows you to lookup a location by address or coordinates for an accurate sales/use tax rate and easily calculates your total. Click here for parish and state contact information. Website Support. Phone. (877) 693-4435. Fax. (225) 231-6201.

![225] Magazine - July 2021 by Baton Rouge Business Report - Issuu](https://image.isu.pub/210629210426-4b8af1a888342426070a321921ef184f/jpg/page_1.jpg)

Source Image: issuu.com

Download Image

thewestsidejournal.com | The official journal of West Baton Rouge The minimum combined 2024 sales tax rate for West Baton Rouge Parish, Louisiana is . This is the total of state and parish sales tax rates. The Louisiana state sales tax rate is currently %. The West Baton Rouge Parish sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.

Source Image: thewestsidejournal.com

Download Image

Sales and Use Tax Department – Lafourche Parish School District Louisiana has a 4.45% sales tax and West Baton Rouge Parish collects an additional 5%, so the minimum sales tax rate in West Baton Rouge Parish is 9.45% (not including any city or special district taxes). This table shows the total sales tax rates for all cities and towns in West Baton Rouge Parish, including all local taxes. City. Sales Tax Rate.

.png)

Source Image: mylpsd.com

Download Image

West Baton Rouge Parish, LA – Photo Gallery 850 8th Street. PO Box 129. Port Allen, LA 70767. Phone: 225-343-9234. Fax: 225-344-1004. Law Enforcement Resources. Report a Crime. Pay Taxes Online. Pay Tickets Online.

Source Image: westbatonrougemuseum.org

Download Image

Keep West Baton Rouge Beautiful

West Baton Rouge Parish, LA – Photo Gallery The Revenue Division of the City of Baton Rouge Finance Department allows you to file East Baton Rouge sales tax returns via Parish E-File. Sales and Use Tax Due Dates. Find sales and use tax due dates. Sales & Use Tax Guidelines. The City-Parish Finance Director has been designated as the central collector for sales and use tax in East Baton

225] Magazine – July 2021 by Baton Rouge Business Report – Issuu Sales and Use Tax Department – Lafourche Parish School District The minimum combined 2024 sales tax rate for West Baton Rouge Parish, Louisiana is . This is the total of state and parish sales tax rates. The Louisiana state sales tax rate is currently %. The West Baton Rouge Parish sales tax rate is %. The 2018 United States Supreme Court decision in South Dakota v.